The word “soft” can be seen as a good thing or a bad thing. Hearing “soft bed” may conjure images of comfort and luxury, whereas saying someone has “gone soft” can mean they are failing to meet expectations.

In the case of project savings, “hard” vs. “soft” savings are not a matter of good or bad – they are simply different. Whereas hard savings can be measured in dollars, soft savings may be a bit harder to capture with numbers but they are still just as important.

Overview: What are soft savings?

Soft savings are Six Sigma project outcomes that provide some kind of benefit to the organization but do not have a direct impact to the bottom line. These are often intangible and difficult to quantify. Examples include cost avoidance, improved employee morale, and improved company reputation.

3 benefits of soft savings

Just because there is not a direct impact to the organization’s bottom line doesn’t mean soft savings do not benefit the organization. Rather, they benefit the organization in ways not necessarily measured in dollars and cents.

1. They can provide a foundation

Before you build a building, you need to lay the foundation. Working on projects that don’t impact the bottom line is still good for business. Success in these areas can build a platform for focusing on areas associated with hard savings in the future.

2. They demonstrate the value of Six Sigma

While many people associate Lean Six Sigma projects with increased revenue or reduced costs, these are not the only areas this methodology can help improve. Capturing soft savings associated with Six Sigma projects helps showcase its value.

3. They serve as an additional metric

Measuring soft savings can serve as additional business metrics to set process baselines, aid in project prioritization, and showcase the value of an organization’s Six Sigma program.

Why are soft savings important to understand?

While businesses need to be profitable, money isn’t the only thing that keeps them running smoothly. It is important to understand how the business is doing in areas outside of profits to get a more comprehensive health check for the organization.

Productivity

Soft savings are generally linked to productivity improvements such as reduced lead times. Tracking these types of metrics help companies understand how productive their employees are and where improvements can be made so that more focus is placed on value-added work.

Satisfaction

Increased job satisfaction is another intangible benefit of continuous improvement that falls under soft savings. When employees feel like their employer cares about them, they are more likely to stay with the organization and provide good results.

Increased customer satisfaction is another dimension to consider. While it may not directly impact the bottom line, satisfied customers are less likely to buy from someone else in the future.

Trust

Business revolves around trust. Employers trust their employees to do the work they pay them to do. Employees trust that their employers will look out for their best interests. Customers trust that a business will deliver the products that they say they will deliver.

As such a crucial element of business, any work done to solidify and ensure trust across these various stakeholders will have immeasurable value to an organization and ensure its long-term success.

An industry example of soft savings

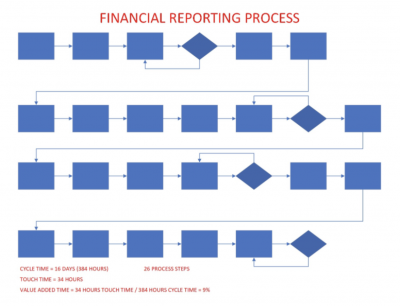

Let’s say your company has a financial reporting process that, as it stands today, typically takes a mere 16 days to complete. So fast! However, if you were to run the process from start to finish without interruption, it would only take 34 hours total (wait, what? Then why is it taking over 2 weeks…?!).

Here’s what the process looks like:

Image source: LinkedIn.com.

To calculate the cost of running this process, you can calculate the cost per hour for those doing the work. If employees doing this process are paid $25/hour on average, then the cost of running one cycle of this financial process = $25/hr X 34hrs = $850. If we run this process 100 times per year, the annual cost is $850/cycle X 100 cycles/year = $85,000.

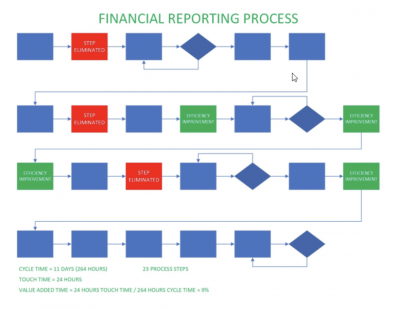

In the spirit of continuous improvement, Benny Blackbelt decides to run a project to make this process more efficient. After identifying non-value added activities and improving how some of the value-added steps are performed, the team was able to reduce the amount of time this process takes from 16 days to 11 days, ultimately taking 24 hours with no interruptions.

Here’s the new process:

Image source: LinkedIn.com.

It’s not a good idea to calculate savings based on the 5-day reduction in cycle time, because much of that time was spent waiting in between steps. In most cases, people are not sitting around waiting for their step to start; they are working on other things in the meantime.

To calculate the soft savings for this project, we can compare the actual time taken of the old process to that of the new one and multiply the time savings by the cost per hour to do the work.

In this example, the actual process time was reduced by 10 hours: 10 hrs saved/cycle X $25 / hr = $250. Run 100 times per year, the annual savings is $25,000.

As we’re talking about soft savings, we didn’t literally save $25,000 for the organization. Another way to look at it is that we freed up 1,000 hours of labor. Our current employees can spend this time on other work, so we don’t even have to hire a new employee to improve output!

3 best practices when thinking about soft savings

While business leaders love to hear about the money being saved, you can also use soft savings to show big impacts to the organization. Here are some things to keep in mind.

1. Ensure you have alignment with your finance department

Even if you’re not calculating actual dollars saved, it’s important to have alignment with your finance department for what constitutes hard vs. soft savings and how these will be calculated. This will help ensure that savings are not being double-counted across project work.

2. Highlight the organizational value

Even though soft savings do not directly impact a company’s bottom line, that doesn’t mean there is no value to focusing on these types of improvements. Whether it’s better resource allocation, improved customer satisfaction, or improved employee morale, these are still valuable to help an organization achieve success. Being able to articulate this value outside of the dollars is crucial.

3. Check your prioritization

It is important to balance saving money and enabling future savings. As organizations mature in their Six Sigma journeys, they may find that the “low-hanging fruit” of big dollars to save per project dries up. When assessing where to focus your improvement efforts, take both dollars and less tangible forms of value into account when prioritizing potential projects.

Frequently Asked Questions (FAQ) about soft savings

What is the difference between hard savings and soft savings?

Hard savings have a clear and direct impact on a company’s bottom line — they improve profitability. Soft savings also benefit the organization, but they do not have this direct impact and are often harder to calculate.

How do you calculate soft savings?

The answer to this question depends on the type of soft savings associated with your project. For example, if you are working on a project to reduce customer lead time, the soft savings associated may be calculated as the difference between the old lead time and the new one (i.e., we saved the customer 5 days of waiting for our product).

Why is it important to track soft savings?

While harder to calculate and having no direct impact, soft savings can indicate the potential future dollars to the bottom line. By tracking the results of enabling processes to run more effectively, the organization sets itself up to run additional projects with hard savings.

The hard part of soft savings

In a metrics-driven field, it can be difficult to make time to keep track of things that don’t have an immediate impact on an organization’s bottom line. However, money is not the only thing that keeps companies running. Trust, employee satisfaction, job safety…while these things are hard to measure, these soft savings are essential to keeping an organization profitable for years to come.